Deal Tracker

Community Benefits Summary:

From January 2019 to December 31, 2025, 3.63 gigawatts (GW) of renewable energy have been purchased through PPAs, enabling a total of 4.77 GW of project capacity. This equates to 14,700 gigawatt-hours per year of energy provided, leading to:

- the creation of 7,000 jobs,

- $7.5 billion in capital investment, and

- production of enough energy to power 1.9 million homes.

Unlock all our content by joining the BRC-Canada community

Deal Tracker Table

Details on deals and projects, as well as other information on corporate renewable developments and trends in Canada, are exclusively available to participating organizations of BRC-Canada.

About the Deal Tracker

The primary goal of the Deal Tracker is to increase public awareness of the initiatives corporate buyers are taking to procure renewable energy for their own targets and for emissions reduction obligations. Transactions in the Deal Tracker consist of renewable energy projects where a corporation or institutional buyer has announced or disclosed an agreement to support the growth of renewable energy in Canada.

Archive of Quarterly Updates

Scroll through our archive to see previous editions of the Deal Tracker and highlights from each quarter since 2021.

Unlock all our content by joining the BRC-Canada community

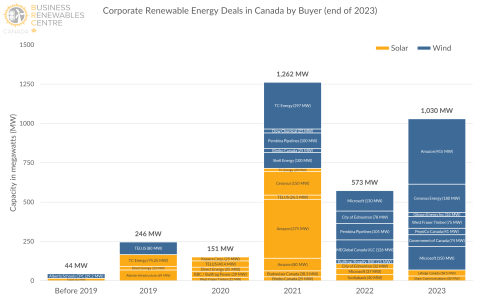

Corporate Renewable Energy Deals in Canada by Buyer and Developer

These graphs provide a detailed look at who was involved in all the corporate renewable energy deals that qualified under our Deal Tracker criteria.