Will the province risk revenues for Albertans in south and central regions?

By Hanneke Brooymans, BRC-Canada Senior Communications Lead

February 27, 2024

If you asked Albertans whether or not they should be able to benefit from the energy resources found in their region of the province, you would get a firm “yes” from most.

And they would expect their provincial government to help them. Certainly, the province has rarely done the opposite.

It’s surprising then, that we find ourselves in a situation where we’re holding our breaths to see what comes out of the renewable energy inquiry.

And the thing is, most Albertans may not realize what’s at stake for them — especially those living in southern and central Alberta.

These areas of the province are extravagantly endowed with wind and solar resources, forms of energy that will never run out. What does this mean, financially? And who has told them about their prospects?

The richness of the resource is certainly not a secret among clean energy developers. They’ve invested $10 billion in wind and solar projects so far. And there are another 120 projects they had intended to proceed with – before the provincial government called a sudden halt to project approvals.

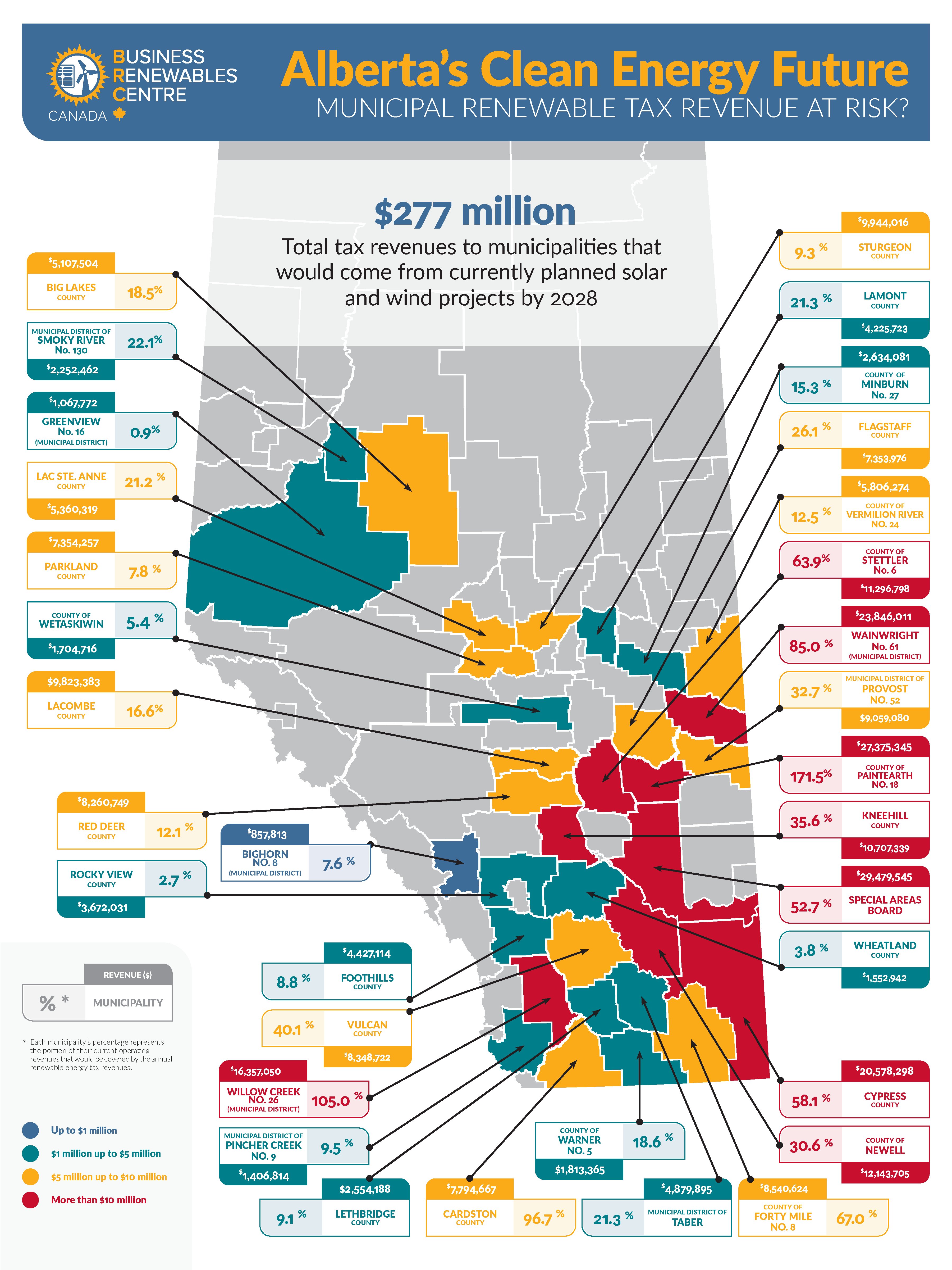

Those planned projects — not the completed ones or the ones currently under construction — would bring 33 municipalities $277 million annually in tax revenues by 2028. (You can see a breakdown of the amounts each municipality can expect in this infographic.)

Our conservative calculations revealed that, if all these projects are allowed to go through, eight municipalities would be making at least 50 per cent of their current operating revenues. Another nine would be making 20 to 50 per cent of their operating revenues.

Imagine what these communities could do with this income. And this is a steady, reliable source of revenue.

This could change some power dynamics as it would give municipalities a newfound independence.

If Hanna wants to build its Harvest Sky Agricultural Centre or develop its historic Railway Roundhouse as a modern community activity hub, the Special Areas Board could soon be flush with the kind of cash to make that happen. Or the municipality could decide to accelerate its irrigation project, a linchpin initiative which could impact the collective prosperity of the community.

Funds could flow to Paintearth County’s Castor splash park, or the municipality could easily build Coronation School’s inclusive playground.

While these projects may be proceeding under the capable hands of residents right now, it is possible to imagine that with additional, substantial new revenues, they would proceed more quickly. The new financial footing would enable communities to create bigger plans with longer outlooks on the basis of solid revenue forecasts. They might decide not to wait for provincial government decisions on funding or grants. Aside from the quality-of-life improvements each of these projects will bring to the people living there, many of these projects have their own projections for additional spin-off economic benefits.

There’s a big “if” looming over this bright future, though. The Alberta government could change the trajectory of the projected growth.

That’s because the provincial government is about to lift the pause it instituted last August on renewable energy project approvals, but it’s promising to do so with some new rules. And everyone in the renewable energy industry is now wondering: how many wind and solar projects will no longer go ahead under the new rules?

This could happen, literally, if they introduce severe restrictions on placement of projects. Or it could happen financially, if the rule changes bring new, substantial costs that aren’t present in other jurisdictions, either in Canada or internationally. The wind blows and the sun shines in a lot of other places. Wind and solar developers have choices, and they can take their dollars elsewhere.

And who would suffer? Residents of southern Alberta.