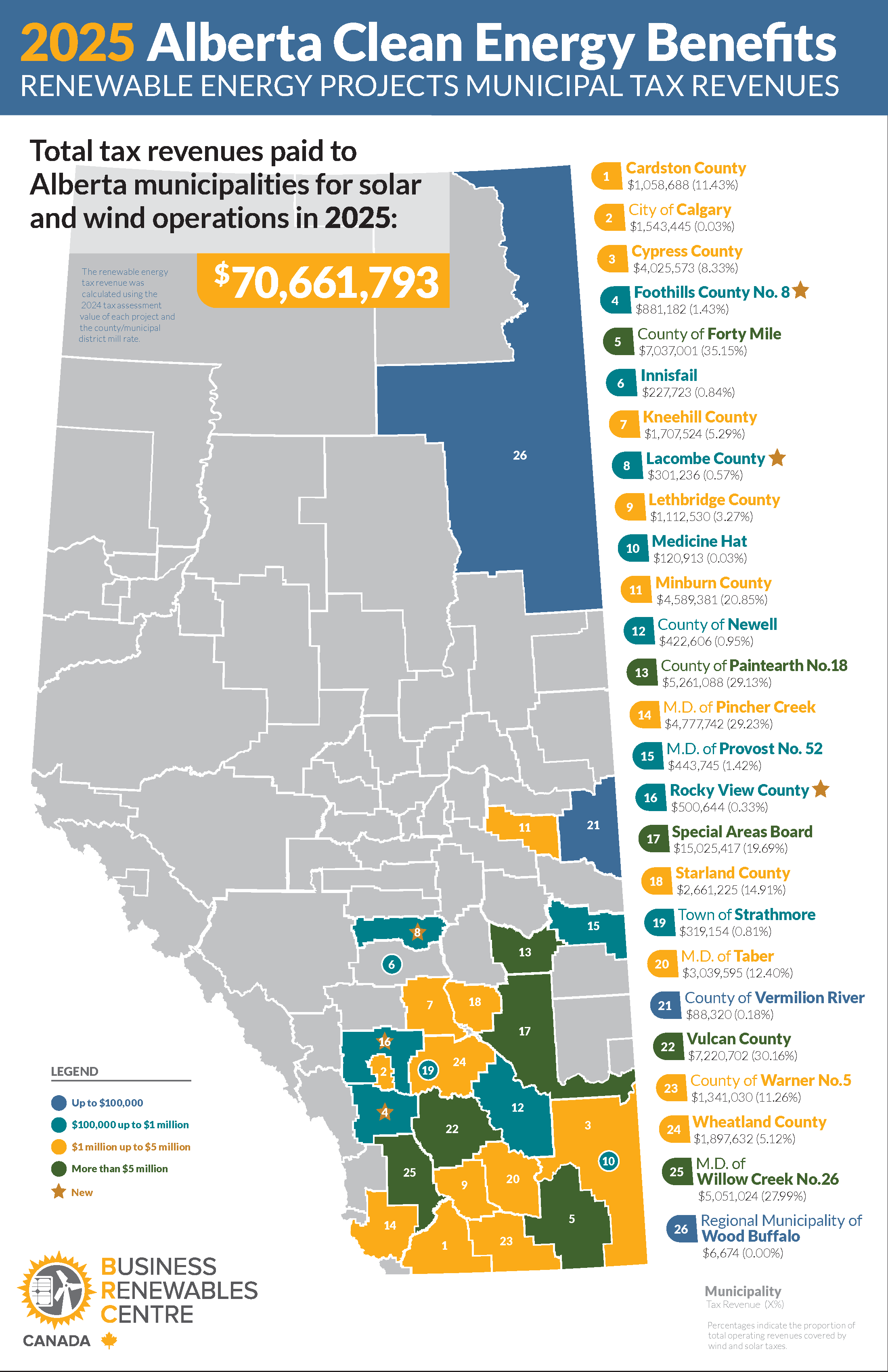

Alberta's wind and solar projects deliver $70 million to local communities in 2025

By Margret Nellissery, BRC-Canada Senior Analyst and Jean Todea, Senior Communications Lead

It’s that time of the year again!

We’re back with this year’s Renewable Energy Municipal Tax Revenue Map, and it’s bigger than ever with more counties, more projects, and more revenue to celebrate.

This year, municipalities in Alberta received $70 million in municipal tax revenues from solar and wind projects. This represents a significant leap from previous years and serves as a powerful indicator of the benefits wind and solar energy projects continue to have on counties and local economies throughout the province.

- Highlights from 2025: 2025 revenues saw a 30 per cent increase from 2024 ($54 million) and a 151 per cent increase from 2023 ($28 million).

- This year’s increase comes entirely from 20 new projects that are currently operational and were assessed for the first time. Without these new additions, total revenue would have been approximately $51.8 million – roughly in line with projects assessed in 2024. This highlights the transformative potential of new project development for municipal revenues. Twenty-six counties share the renewable energy tax revenue. Four new counties were added to the list of hosts this year – slightly fewer than the five that joined in 2024.

- While the number of new projects added this year is around the same as last year, the added capacity is 38 per cent lower than in 2024.

- Both a project’s assessed value and a county or municipality’s tax rate dictate how much revenue is generated. However, small changes in these two numbers do not significantly impact revenue. What makes a big difference to how much revenue a county receives is adding a new project, as this year’s results clearly demonstrate.

Municipal tax revenue over the years

Looking back over the past three years, one thing is clear: projects already up and running continue to bring in steady revenue, while new projects add a significant boost each year.

Our three-year snapshot doesn’t yet show the long-term effects of depreciation on assessed values. But what we do see is that continued investment in new projects maintains momentum and drives municipal revenue growth. If Alberta continues to attract renewable energy investment, municipalities can expect their tax revenues to remain strong.

These municipal tax revenues are over and above any other community benefit agreements that may in place, as well as landowner leases which can be as much as $600-$1200 per acre.

Wind versus solar

This year’s revenue comes from 37 wind projects and 49 solar projects – a healthy number for both technologies, but very different histories.

Historically, Alberta has seen more wind capacity built than solar, so wind projects still account for the larger share of total revenue. But when comparing revenue per megawatt, the two energy sources are nearly identical in their contribution. This parity suggests that both technologies offer similar advantages for municipalities, and communities can benefit regardless of which type of project they host.

As solar development continues to accelerate globally, we might expect this balance to shift further in Alberta, potentially creating even more opportunities for diverse geographic regions to participate in and benefit from a more diversified supply mix.

Looking ahead

The 2025 Municipal Tax Revenue Map tells a story of remarkable growth, expanding opportunity, and genuine economic impact for communities across Alberta. With $70 million flowing into municipal budgets, renewable energy projects are proving to be far more than just environmental initiatives – they're economic engines that support local services, infrastructure, and community development.

Wind and solar are now the lowest-cost options for new electricity generation – a reality that's reshaping energy markets worldwide. In 2025, renewable energy overtook coal globally as the largest source of electricity. Alberta has been part of this shift, with wind and solar competing effectively in the province's electricity market.

However, as we look toward 2026 and beyond, the trajectory is uncertain: ongoing policy uncertainty and rising project cancellation rates put long-term tax revenue growth at risk. According to our Deal Tracker, the Alberta power purchase agreement market has dropped 96 per cent over the past two years. Restoring Alberta’s competitiveness in renewable energy investment is critical to ensuring long-term prosperity alongside a cleaner energy future.

You can access the full infographic, 2025 Alberta renewable energy municipal tax revenue map, on the BRC-Canada website.