Rising renewable energy revenues face headwinds of regulatory uncertainty

By Hanneke Brooymans, BRC-Canada Senior Communications Lead

It’s a tale of two figures.

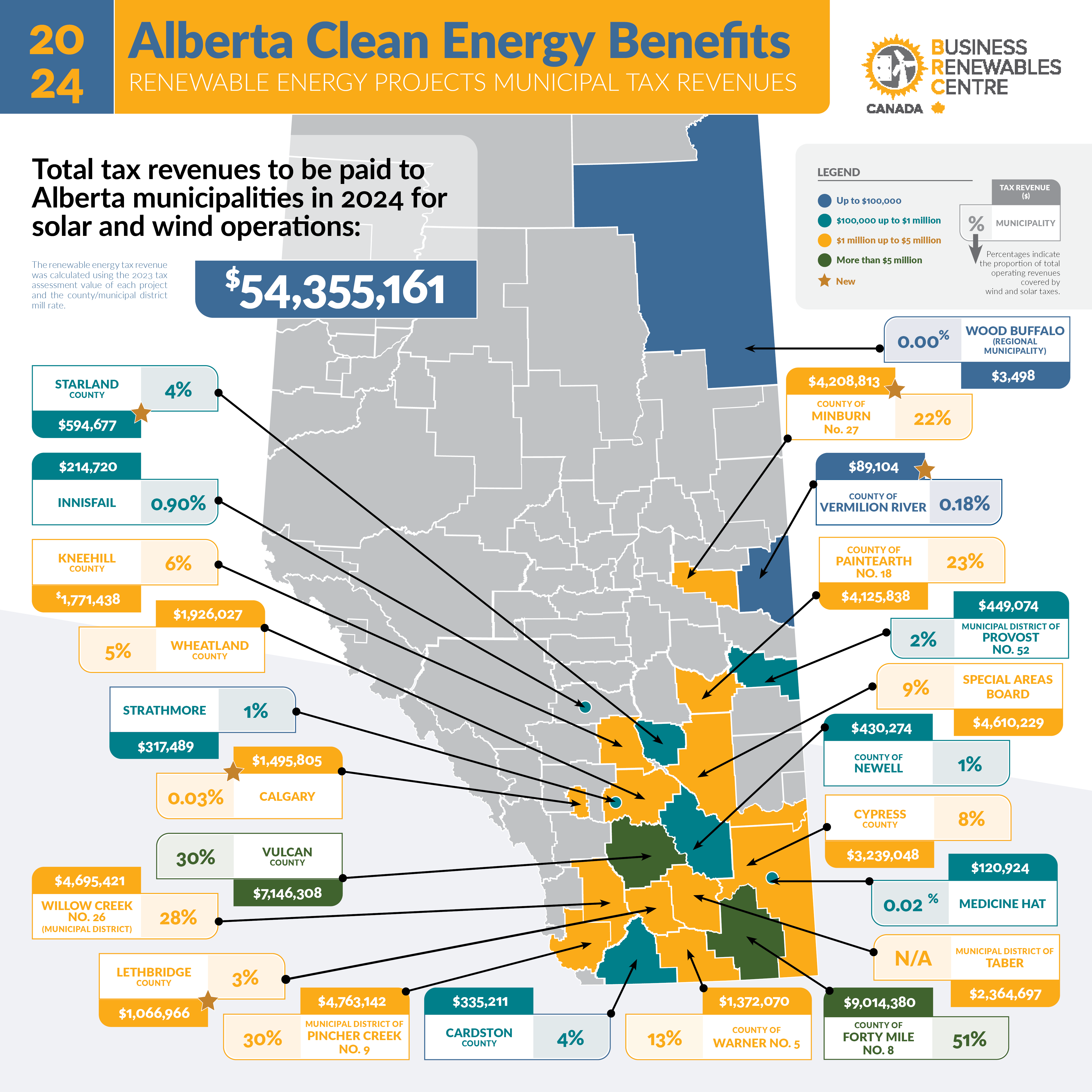

There’s the bright, happy one that shows $54 million will be collected by Alberta municipalities this year for tax revenues on wind and solar projects.

And then there’s the $91 million in potential annual municipal tax revenues lost from the clean energy projects that were cancelled in the past year.

These two numbers are a before-and-after snapshot of the renewable energy moratorium announced a year ago by the Alberta government.

The near doubling of municipal tax revenues in the past year (from $28 million to $54 million) represents projects that were all initiated, approved and constructed before the moratorium.

The five-fold increase in project cancellations seen since the moratorium adds up to $91 million in lost potential revenues. (We made some very conservative assumptions when calculating this amount.)

The renewable energy industry has clearly hit the brakes. This may be difficult to spot when one observes the thousands of megawatts of projects still being proposed. But this is a pretty constant phenomenon in Alberta. And it’s well known that they don’t all proceed.

What has changed is the project cancellation rate. It’s also clear that the pace of corporate power purchase agreements (PPAs) has also plummeted. This is evident in the Deal Tracker we maintain for all corporate PPA deals in Canada. There’s been an abrupt change — the first half of 2024 has been the slowest for the Alberta PPA market since 2020, with only one deal announced so far.

Corporations that buy clean energy in these PPAs support the construction of clean, affordable energy projects by providing the financial backing banks want to see before they offer financing. The 3.31 gigawatts (GW) of renewable energy purchased through PPAs between January 2019 and June 30, 2024, enabled the construction of 4.10 GW of project capacity. That led to $6.4 billion in capital investment, which in turn created 6,200 jobs and production of enough energy to power 1.7 million homes.

The drop in PPAs means corporations across Canada may have difficulty hitting their sustainability targets with the most cost-effective solution. And it means Alberta is adding less clean, affordable electricity to the grid, which has an impact on the energy bills of Albertans and limits economic growth.

Alberta’s renewable energy moratorium ended on February 29, 2024. So why are we still seeing a high number of cancellations?

The clean energy industry continues to labour under confusing regulatory headwinds and this uncertainty has drained confidence and energy from Alberta’s market.

Still buffeting the market are the reviews of regulations relating to land use, a market restructuring, and a transmission system policy overhaul. None of these layers of policy uncertainty has been resolved sufficiently to enable corporate offtake agreements, project financing or investment decisions. With the government’s planned timelines for legislation, it looks like there are many months of uncertainty still to come.

This will hit the pocketbooks of municipalities that may have been counting on revenues from these projects. Communities like Innisfail are already feeling the effects.

BRC-Canada is asking the government to restore confidence in the market by quickly resolving the new risks of unnecessary red tape, regulatory charges and market complexity. Only then will they restore the economic momentum that has brought thousands of jobs and millions in municipal revenues to the province.