Renewable energy tax revenues add up to windfall for Alberta municipalities

MEDIA RELEASE

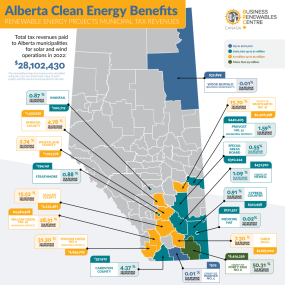

CALGARY — Renewable energy is fattening the coffers of many municipalities in southern Alberta in the form of municipal tax revenues coming in from wind and solar projects in their communities, according to new analysis by the Business Renewables Centre-Canada (BRC-Canada).

The amount of municipal tax revenue coming in from renewable energy has almost tripled to $28 million since this amount was first estimated back in 2017. BRC-Canada obtained the 2022 tax assessment value of each project and the county/municipal district mill rate in order to calculate the exact amount received by each municipality.

Some municipalities, with more or larger projects, are seeing a substantial proportion of their tax revenues coming from wind and solar projects. This includes the County of Forty Mile (50 per cent), the M.D. of Pincher Creek (31 per cent), the M.D. of Willow Creek (29 per cent), the County of Paintearth (16 per cent) and Vulcan County (15 per cent).

“Given these numbers, it’s unsurprising that a new Pembina Institute poll showed 75 per cent of Albertans — including 66 per cent of Albertans living outside of Edmonton and Calgary — would like to see more renewable energy projects where they live,” said Jorden Dye, director of BRC-Canada. “Aside from the fact that these projects are producing non-polluting, emissions-free energy, they also help plump up community coffers. This ultimately means those communities have the freedom to lower taxes, tackle badly-needed projects or provide additional services.”

Dye noted that projections show additional prosperity on the horizon for these communities.

“Based on the 2022 calculations and the projects currently in the Alberta Electric System Operator connection queue, these municipalities can expect that amount to grow by six to nine times — that's an additional $170 million to $250 million — in just a few years.”

Jorden Dye, director of the Business Renewables Centre-Canada, is available for comment.

Quick facts

As of September 30, 2023, 2.85 gigawatts (GW) of renewable energy has been purchased through corporate power purchase agreements, enabling a total of 3.61 GW of project capacity. This equates to 10,532 gigawatt-hours per year of energy provided, leading to the creation of:

-

5,900 jobs,

-

$5.5 billion in capital investment, and

-

production of enough energy to power 1.5 million homes.

Polling data methodology

Survey questions were administered through the TrendWatch Alberta Omnibus Survey under the direction of Janet Brown Opinion Research between September 13 and 26, 2023. TrendWatch Alberta is a monthly omnibus survey of 900 Albertans, ages 18 and over. The margin of error for a probability sample of 900 people is plus or minus 3.3 percentage points, 19 times out of 20 (i.e., at a 95 per cent confidence interval).

Background

The Business Renewables Centre-Canada (BRC-Canada) is an initiative of the Pembina Institute. BRC-Canada exists to enable businesses and institutions to access renewable energy for their emissions reduction needs across Canada. This means working closely with buyers and developers of renewables and assisting them in shortening their learning curves as they figure out the best path to power purchase agreements. Our growing organization currently has about 60 participants from across all sectors of the Canadian economy.

-30-

Contact

Hanneke Brooymans

Senior Communications Lead, Pembina Institute

587-336-4396

Background

Infographic: Alberta Clean Energy Benefits: Renewable Energy Projects Municipal Tax Revenues

Polling data: Key polling results and data tables

Blog: Renewable energy’s role in a reliable power system

Blog: Renewable energy’s distinct reclamation path

Statistics: See our Deal Tracker web page for quarterly updates on community benefits